4 limitations of industrial solar systems – and how to overcome them

SAGE Automation, Published: September 13, 2018 - Updated: September 27, 2023 (11 min read)

Recent cost reductions in solar technologies and a changing energy landscape has seen a wave of industrial businesses install industrial solar pv systems to slash their electricity bills.

As other businesses look to do the same, it will pay to do the research and understand exactly how maximum ROI can be gained from solar. This is because the nature of the sun, the energy market, current technology availability and the way industrial operators are billed, means less can be gained from installing solar panels on their own.

But businesses are seeing solar's value, for example first movers like Sanjeev Gupta, SA Water CEO Roch Cheroux, and Kingspan CEO Gene Murtagh, have all announced ‘Net Zero Energy’ projects that will harness solar in some way.

These projects have some commonality: they harness energy management systems, storage and often a mix of renewables. Such systems are being called Distributed Energy Resources (DER), and they’re set to power 60 percent of Australia by 2050.

Those wanting to make the most of industrial or commercial-scale solar will benefit from following suit.

This article will show you some limitations of solar, and how to overcome them. This will ensure your solar initiative will be configured to return the highest yield – now and for many years to come.

So, here it is, why solar ALONE, isn’t enough:

1. Solar is non-dispatchable energy, so is wasted if not stored

While traditional power sources are dispatchable, and can dish out power whenever we need it, the sun’s energy is intermittent and without storage, solar can’t supply electricity on demand.

But it does generate considerable energy supply in the day. Increasingly we’re producing more solar electricity than we can consume.

So, to gain the most from solar, the business or industrial operation should capture excess energy with storage or look at demand response activities to shift loads or operate when solar is at its peak.

Recap – The cost of large-scale battery storage has dipped by 40 percent [Bloomberg paywall] since 2014, and the Telsa battery and other research and commercialisation projects are ramping up:

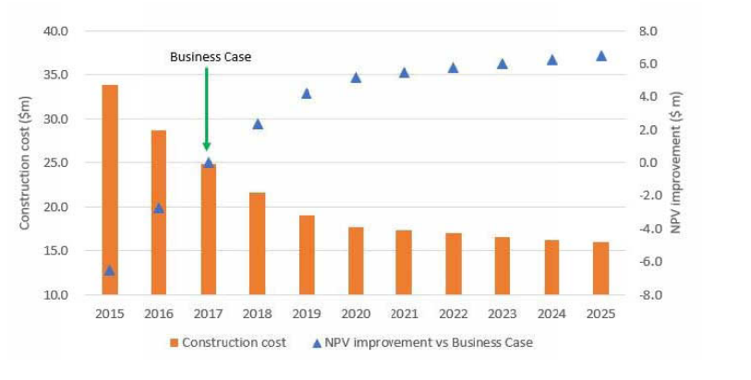

A real business case for commercial operation of grid batteries arises as the net present value (NPV) tips. Image: ARENA

Load shifting also represents an opportunity to maximise solar ROI:

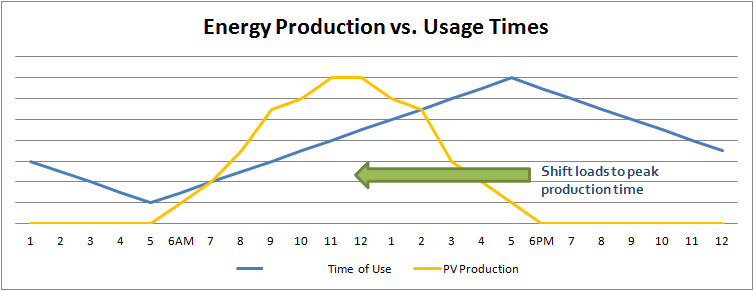

Shift electricity usage to when solar energy is produced. Image: AltE

2. The more attractive sell-back markets require more than just solar panels…

To our knowledge, there are three markets that commercial and industrial scale businesses with renewables can operate within, provided they meet certain criteria:

- Solar feed-in tariffs

- Renewable Energy Credits

- Ancillary market/s

Below, we briefly touch on each:

1. Solar feed-in tariffs

Historic solar feed-in tariffs have been influential in getting the residential market on-board. But like the residential market, the commercial feed-in tariff rate has reduced from a round 40 cents per every kilowatt hour (kWh) sold back to the grid, to just 8c/kWh with a standard supply rate of 33.91c/kWh and peak rate around the 50c/kWh mark [Origin NSW fact sheet].

The financial incentive to sell solar to the grid has vanished.

*Feed-in tariff rates vary state to state, and distributor to distributor. Check with your distributor here.

2. Renewable Energy Credits

Accredited commercial, industrial or utility businesses with surplus renewable energy may be able to sell Large-scale Generation Certificates (LGCs) to coal fire generators or electricity providers who are required to purchase a set amount under the Renewable Energy Target scheme. Read: How to participate in the REC for eligibility criteria.

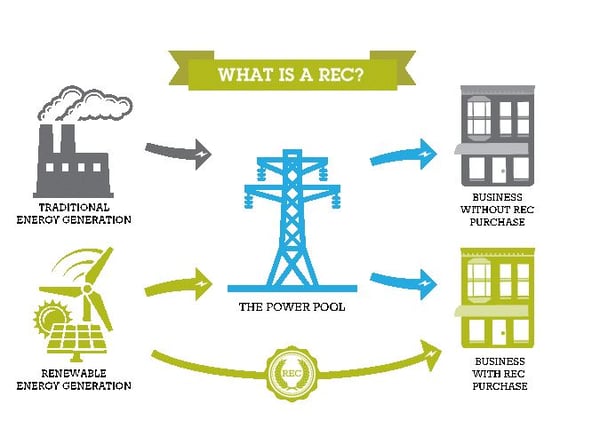

Renewable energy credits such as Large Scale Certificates can be traded. Image: Michael Hartzell

3. Ancillary markets

If your operation can supply the grid with temporary high bursts of power when it’s needed, you may gain from ancillary markets that have typically been set aside for commercial power generators. The sell back rates are attractive.

But solar panels alone don’t entitle you to operate in the market. AEMO sets strict performance parameters and requirements including having a control system, high speed data record, high speed metering, and telemetry protocols to enable communication between your operation and the utility.

AEMO also says that sophisticated renewable generation like DER systems are enabling more large scale businesses to join the ancillary market.

Recap – Entry into the ancillary markets and the LGC market could yield a healthier return than only opting for solar feed-in. Entry depends on the size and set up of your solar system. Typically these markets require you to meet high standards of control systems and data for record keeping and communication with the utility.

3. Plus the way businesses are billed means they get less bang for buck

In line with the Australian Energy Market Commission regulations, business and residential customers will (or soon will) pay cost-reflective tariffs. [Sources: 1, 2, 3, 4, 5]

This means the way you’re billed reflects the ‘actual demand’ you put on the grid not your cumulative usage.

Calculating actual demand

The Actual Demand Charge is usually calculated based on the maximum recorded ‘demand’ or usage in the peak and shoulder periods since the last meter read. The ‘level of demand’ is worked out by how much electricity needed in any one 30 minute interval.

Running motors, lights and appliances at the same time results in higher network demand and higher demand charges.

Can solar offset actual demand?

There’s an obvious incentive for businesses to reduce actual demand and level out their load. While solar can offset the amount of grid energy you use, its intermittency can limit your ability to consistently reduce demand.

But control systems and sub metering as part of a DER system can:

a) show you which systems and devices consume the most power and then...

b) automatically draw from on-site generation units such as solar, generators or stored energy to offset grid demand.

Recap: Solar alone can’t reduce demand charges at all times of the day, and year. Some of the answer lies in having a mix of energy generation types on-site and program them to run during energy intensive processes to ‘shift loads’ and offset grid demand charges.

4. Solar doesn’t necessarily protect you from the grid instability

Standard grid connected solar is designed to disconnect from the grid and stop producing energy when the grid goes down. If it remains ‘on’, it’ll feedback power out to the grid – which is highly dangerous for any repair or maintenance works required.

Recap: Solar won’t necessarily protect the business from grid instability – businesses should protect themselves from downtime risk with a system that can safety isolate itself (called ‘islanding’) to keep producing backup electricity during disturbances. DERs and Microgrids offer such functionality.

Conclusion

While the return on solar isn’t as clear cut as some might think, there’s enormous opportunity for businesses to take advantage of industrial-scale solar energy generation.

As we’ve found, it will pay to understand exactly how the market, technology and your own sub-systems and electricity contract interplay to impact your energy needs.

The nature of the sun’s intermittency, the feed-in schemes and markets, the grid and billing charges, means that in-order to gain the most from solar, control systems, data, telemetry and communication systems and/or other renewables and backup systems may be required.

Doing your due diligence will help you confidently make the right decisions to secure the businesses’ energy reliability as other companies move into this market.

The next blog explores distributed energy resources (DERs) and how organisations, utilities and grid operators are gaining from them. You can read the blog here: What are distributed energy resources and how can they reduce industrial power bills?

Still exploring your energy needs and options? Our free guide to managing industrial energy costs explores the energy market and current technologies that are giving heavy energy users saving opportunities. The guide covers: What energy challenges are big businesses facing?, Energy Management & Measurement, Making financial savings through improved energy efficiency, Distributed Energy Resources and Industry 4.0 Enhancements.

Download your free copy today: The graphical guide to managing industrial energy costs [with renewables and Industry 4.0]