The developments that make smart grid solutions a must for Australia

Paul Moore, Published: October 20, 2021 - Updated: December 15, 2021 (9 min read)

Lower energy bills, better reliability and more sustainable energy are all enticing reasons for Australians to embrace smart grids.

Of course, moving from traditional energy grids to smart grids is not as simple as flicking a switch. There’s many complexities to the Australian energy market, and the ability of consumers to ‘play’ in this market has been limited.

Over the last few weeks, we’ve been taking a deeper look at smart grids, where they fit in the Australian energy market and the regulations that might impact this shift. If you missed part one or part two of this series, make sure you check them out.

In this blog, we will look at system operations and rule changes for smart grids, such as demand-side participation, the new 5-minute settlement market change and the new FFR market, electric charging, and the evolving hydrogen economy.

Demand side participation

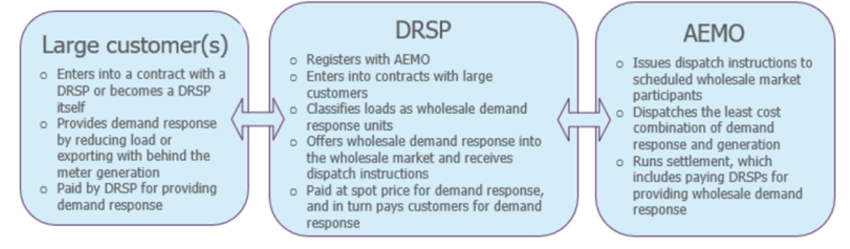

The wholesale demand response mechanism comes into effect on 24th October 2021. Demand response to date has primarily been an ancillary service in the NEM and available to a relatively limited number of participants. Participants can now respond to pricing signals from the market, not just to emergency and contingency type events.

This change elevates the role of demand response in the Australian energy market while opening up involvement for a far wider range of participants than was previously possible. The mechanism introduces a new market player known as ‘Demand Response Service Provider’ (DRSP).

The DRSP aggregates their client’s loads to bid into the National Electricity Market (NEM). When additional generation capacity is required in the market, the DRSP can bid their aggregated load as a form of “Negawatts” in competition with other traditional generators. The market operator (AEMO in Australia) then stacks the bids from lowest to highest and dispatches the lowest cost generation (or Negawatts in this new case) to meet demand. Successful bidders then receive payment in the form of the averaged interval price. The DRSP would then compensate their clients for loads that were turned off for that interval based on whatever contracts they have in place.

The figure below from EcoGeneration illustrates the process nicely.

Above: Wholesale demand response mechanism

Above: Wholesale demand response mechanism

The energy market is far more complex than what I’ve just described here, and there are a lot of variables at play. AEMO has got some great articles if you want to read further on wholesale demand response mechanisms.

5-minute settlement and FFR markets

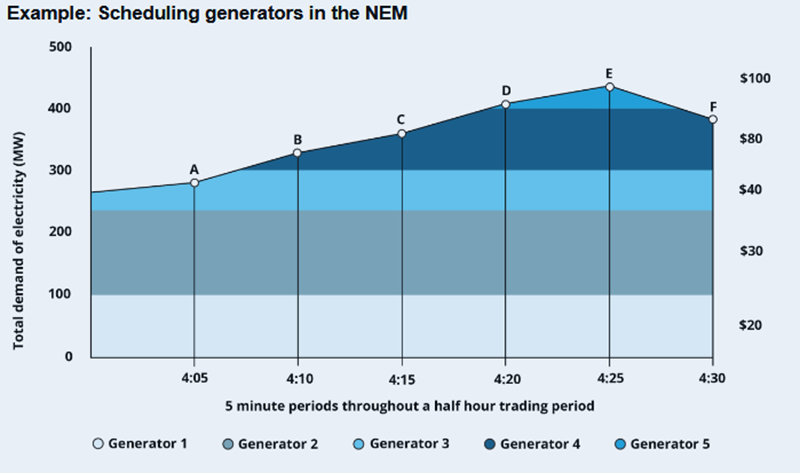

To enable a decarbonised power grid, flexibility (not capacity) is what’s needed. It’s often argued that the power grid can’t survive without baseload coal-fired power stations with capacity available when it’s needed. This is simply not true with smart grids. Variable renewable energy generation requires flexible storage and demand-side control to enable a reliable low-cost power grid into the future. Baseload power in the traditional sense does not fit technically or economically.

Five-minute settlement and the new FFR markets are examples of AEMO recognising this and creating the market conditions and price signals for the future. The 5-minute settlement favours generators that can startup, ramp up or down, and stop quickly. Technologies such as batteries, fast start gas and diesel power stations, and dispatchable loads will perform better economically in this type of market.

Australia’s coal fleet cannot do this. It should be noted that Australia’s coal fleet is of an age where it is unreliable and intermittent in that sense, and financial institutions will not support investment in new coal assets for these (among many other) reasons.

Above: Generation dispatch in the NEM

Above: Generation dispatch in the NEM

Image courtesy of AEMC

As mentioned in our previous blog on smart grid solutions, Virtual Synchronous Machine technology in modern inverters is rendering arguments about system strength and inertia redundant.

Electric vehicles

From a smart grid point of view, Electric Vehicles (EVs) have the potential to become a key part of the energy storage equation, benefitting both the grid technically and consumers financially.

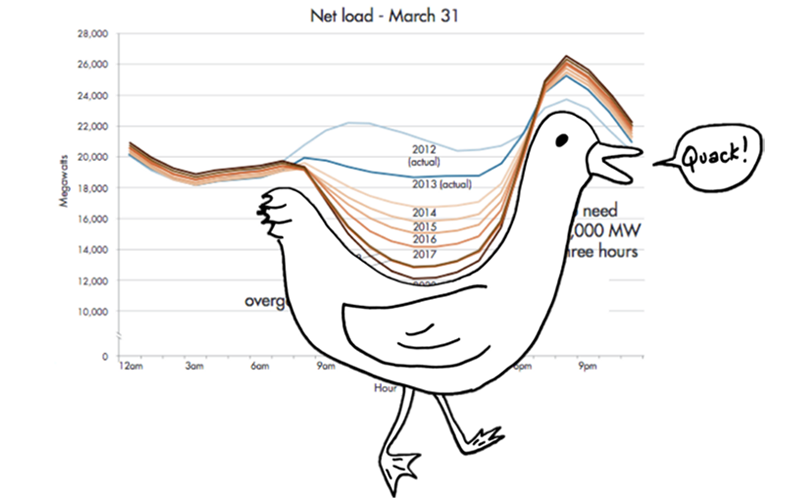

Let me explain the thinking here, the issue of the infamous ‘duck curve' has come into the common language in recent years. This is due to the continued drop in daytime load (measured on the y-axis in Megawatts in Figure 3) mainly due to the massive uptake in rooftop solar, and the increase in peak load during the evening period, giving the signature duck shape to the demand vs time curve.

I had to refer to The Renewable Energy Digest’s illustration to help visualise the idea, and to explain the duck concept:

Above: the duck curve is a well-known illustration of the impact of rooftop solar.

Image courtesy of Medium

Cars are generally parked during the ‘belly’ period of the duck in the middle of the day. The belly reaching 0 Megawatts is a big technical issue for the grid.

Cars charging while parked in the middle of the day will help to guarantee load and value for daytime solar PV, while they can discharge to the grid in the 2-hour early evening period of the ‘head’ of the duck. This will have the effect of flattening out the curve. (Don’t worry, smart energy management systems will ensure that your EV is never discharged below an amount you can set!)

Utilities must build infrastructure to meet the peak period of load (the duck’s head). Flattening it means that less infrastructure needs to be built while raising the ‘belly’ means that existing infrastructure is being used more efficiently and in a more stable operating region.

Hydrogen economy

Hydrogen is an exciting ‘new’ area for a clean smart grid. I say ‘new’ because the idea has been around for a very long time, but the business case has previously not stood up to scrutiny.

Hydrogen is still in the pre-feasibility stage, but recently it has been gaining rapid momentum, attracting a lot of investment from government and private enterprise alike.

There are two main components to the proposed hydrogen economy: electrolysers to create green hydrogen to meet market demand, and hydrogen fuel cells to power heavy haulage and long-haul vehicles.

Green hydrogen is created by using renewable energy to split water into hydrogen and oxygen. Water = H2O, hydrogen = H2 and Oxygen = O2. Methane = CH4, C= carbon.

Green hydrogen does not have any carbon associated with the process of producing it. Green hydrogen is not to be confused with grey or blue hydrogen. The creation of blue hydrogen produces CO2 and uses expensive CCS technology to trap the emissions, while grey and brown hydrogen are heavy carbon emitters.

H2 Bulletin has broken down the colour codes of hydrogen if you’re interested in learning more.

Hydrogen's energy future in Australia

Internationally, many countries are increasing taxes on carbon, providing an opportunity for export markets for low to zero carbon content products. Australia is uniquely positioned to use hydrogen to produce green steel and aluminium for a premium price in international markets. Anyone interested in this concept should read the two recent books (particularly Superpower) from Professor Ross Garnaut, where he details his plan.

Hydrogen fuel cells also show early promise to decarbonise heavy/long haul vehicles such as mining trucks and road trains. Companies like Fortescue Future Industries (FFI) have been actively investing in this space.

Within Australia, the National Hydrogen Strategy is progressing hydrogen industrial hubs, which enables the production of hydrogen at scale. There is a lot happening in the industry, and this is something we'll be keeping a close eye on.

Read more: State Government injects six-figure funding into SA-H2H Hydrogen Technology Cluster

Smart grid technology in our future

An energy future with smart grid technology does mean some significant changes in the fundamentals of our current energy market. As we consider other methods of energy supply, including renewables, there’s a huge need for us to review our systems.

In the next and final part of this smart grid blog series, I’ll talk about increasing consumer market participation, cyber security, and share our thoughts on the future of the smart grid.